Account Types: 529 College Savings Plan Account (Part 4 of a 5 Part Series)

/Some Millennials and Generation Z may have been the beneficiaries of a 529 College Savings Plan account. Now that people in these generations are having children of their own, they may one day need to consider this type of account to help save for their own child’s qualified education expenses. Limits on aggregate contributions to a 529 account are very high and its unlikely most savers will reach these. They are generally opened by a parent or other family member to save for a child’s college education, although they may also be used for qualified K-12 expenses as well.

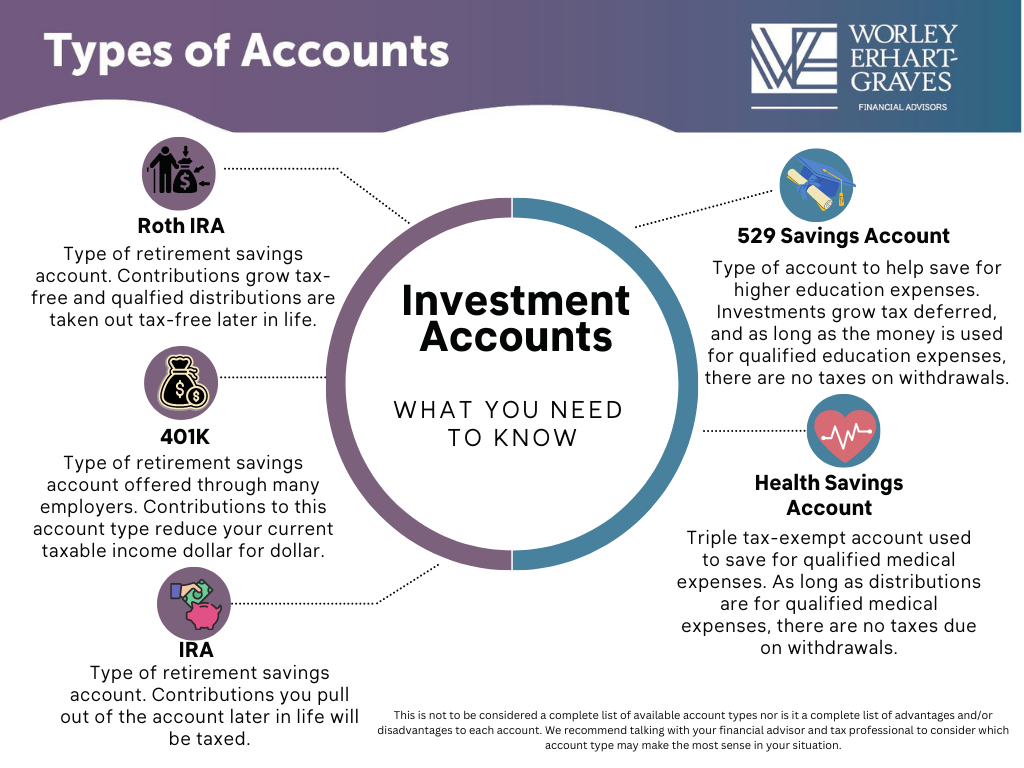

Many states, but not all, offer state income tax benefits to residents who contribute to a 529 account. An investor can open a 529 account in any state, regardless of whether or not they are a resident of that state. In addition, a 529 account can be used to pay for qualified education expenses in any other state. Investments in these accounts grow tax deferred, and as long as the money is used for qualified education expenses, there are no taxes on withdrawals.

There can be penalties for taking money out of this account type for anything other than a qualified education expense and timing of withdrawals must coincide with expenses incurred in the same year.