Goldilock’s Economy?

/2021 has arrived and after a devastating year, it has us all wondering what type of economy awaits us.

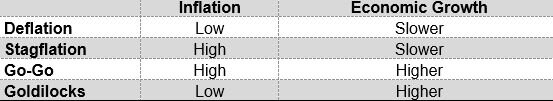

Over the years, economists have defined four types of economies:

The Deflation economy has low-inflation and slower-economic growth which pushes prices down causing people to delay spending because they think there will be a better deal tomorrow. The U.S. experienced deflation between 1930 and 1933, during the Great Depression.

Stagflation existed in the 1970s. It was a time of high-inflation and slower-economic growth. Inflation grew rapidly for a few reasons: The oil embargo caused oil prices to increase 387%, the ongoing costs of the Vietnam war, and the expanding social programs. On the economic side U.S. manufacturing started to move overseas affecting U.S. jobs and consumers started buying Japanese and German made cars which offered better gas mileage. Overall prices increased throughout the decade.

The Go-Go economy has high-inflation and higher-economic growth. In the 1980s, President Reagan lowered taxes so consumers would increase spending. The end result was supply-side economics, trickle-down spending, and a growing budget deficit.

Goldilocks is low-inflation and higher-economic growth. We saw this in the mid-to-late 1990s when productivity was hitting its stride and inflation was on a slow and steady decrease. The phrase Goldilock’s was coined by David Shulman of Solomon Brothers who wrote “The Goldilocks economy: Keeping the Bears at Bay” in March 1992.

The best scenario would be the Goldilock’s economy of low-inflation and higher-economic growth. Like the story goes, the Goldilock’s economy is not too hot or too cold. It’s just right.

Currently, inflation is not a factor as it remains under control. Gross Domestic Product-GDP (the measure used to determine economic growth) is rising. Many economists contribute the rise in GDP to the $2.2 trillion economic stimulus bill passed by Congress on March 27, 2020. The Coronavirus Aid, Relief, and Economic Security Act also known as CARES Act ‘juiced’ earnings when the economy would have otherwise suffered greatly when COVID lockdowns were put in place. Contrary to expectation, the result was low-inflation and higher-economic growth. Does this mean we have the ideal Goldilock’s economy? Or is it all artificial?

We will soon find out. Now that we have a vaccine for COVID 19, hopefully, by the end of 2021, most of the population will be inoculated, and we can go back to growing our economy by reducing unemployment and increasing productivity.